-

Nico Lauridsen

Research Associate

Robert Schuman Centre for Advanced Studies

Read more

Blog

European Central Bank (ECB) and European Court of Justice (ECJ) row over Carige decision

A few days ago the European Court of Justice, at the appeal of a minority shareholder, annulled the decision made by the ECB at the beginning of 2019 to appoint special administrators for the...

Technological developments over the last 20 years have led to the exponential production of data. The availability of data and the power of emerging technologies such as artificial intelligence, machine learning, and blockchain in processing information into data have pushed financial institutions and markets to a crucial moment of change. Data has become an essential component of our society, where value is embedded in sharing and using data to provide customer solutions.

The journey to reclaiming the value of data in financial intermediation is just getting started. Indeed, the open banking model that is designed on top of application programming interface (API) technology has started rethinking and reconceptualising the incumbent’s business models from an ecosystem perspective. Still, the reality is that market-driven approaches to innovation continue to fake the barriers and obstacles of traditional operators that see their marker power position under threat.

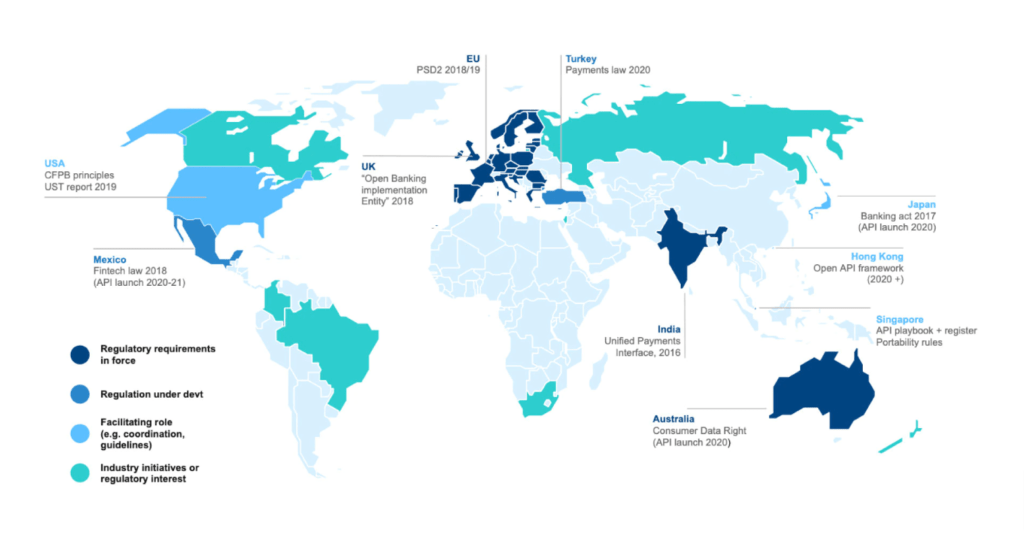

Figure 1 shows the regulatory approaches to open banking, emphasizing the role of regulation in supporting the adoption of API technology with more prescriptive and mandated interventions. Regulatory frameworks are essential to support innovation in mature markets, rising competition, and build the enabling infrastructure to overcome those barriers that slow down the evolution of the fintech market and limit possible emerging risks from technologies.

However, looking with attention at the case of the European Union in the implementation of Payment Services Directive 2 (PSD2), we see that this was the first step for the introduction of the open banking model frameworks insufficient to generate added value for customer leverage on personal data, but the incumbents have seen the introduction of PSD2 as an additional compliance cost and not as an opportunity to start an innovative path to utilize the value of the fintech market. The next step on this fast innovation path is moving from an open banking model to an open finance environment. This must face the duality between the implementation of API technology infrastructure through common standards and the complexity of interacting with multiple regulatory bodies and different supervisory authorities.

To realize the full value of data and promote the embedded financial model across Europe, regulators are working on the interaction of current regulatory bodies and future regulatory frameworks where horizontal regulations such as GDPR and the AI Act interact with vertical regulations such as PSD2. Indeed, this opens the door to a broader discussion about the future regulatory boundaries for entities with novel business models that are currently unregulated or provide multiple services, such as BigTech and SuperApp.

Given the anticipated regulatory challenges and the EU 2020 Digital Finance Strategy, on 24th October the European Commission in cooperation with the three European Supervisory Authorities (ESAs) – European Banking Authority (EBA), European Insurance and Occupational Pensions Authority (EIOPA), European Securities and Markets Authority (ESMA) – and the Florence School of Banking and Finance (FBF) of the European University Institute (EUI), launched the EU Supervisory Digital Finance Academy (EU-SDFA) during a special event held on the EUI premises.

The EU-SDFA is a newly launched initiative funded by the European Union, via the Technical Support Instrument, aiming at training national supervisors from all EU Member States and ESAs’ staff and strengthening their capacity in digital finance in support of the objectives of the 2020 EU Digital Finance Strategy.

More information are available on EU-SDFA website.

This blogpost has been produced in the framework of the EU Supervisory Digital Finance Academy (EU-SDFA).

This blogpost has been produced in the framework of the EU Supervisory Digital Finance Academy (EU-SDFA).

The EU Supervisory Digital Finance Academy (EU-SDFA) is a TSI flagship initiative aimed at supporting financial supervisory authorities in coping with the risks and opportunities associated to the use of advanced technologies in the financial sector. The European Commission – DG Reform has established the Academy in cooperation with the three European Supervisory Authorities (EBA – ESMA – EIOPA) and the Florence School of Banking and Finance part of the Robert Schuman Centre of the European University Institute (FBF-EUI).