-

Julie Pellizzari

Research Associate

Robert Schuman Centre for Advanced Studies

Read more

Blog

Are Social Impact Bonds the ESG panacea?

In a fast-paced sustainable finance market currently struggling with how exactly to best align capital with environmental, social and governance (ESG) objectives, social impact bonds (SIBs) emerge as yet another innovative but puzzling instrument....

Recent reports, such as the UN World Water Development Report 2024, highlight the link between water and peace. Water scarcity affects up to 2.7 billion people for at least one month each year, and crises are projected to escalate as climate change affects rainfall patterns and increases the frequency of extreme weather events.2

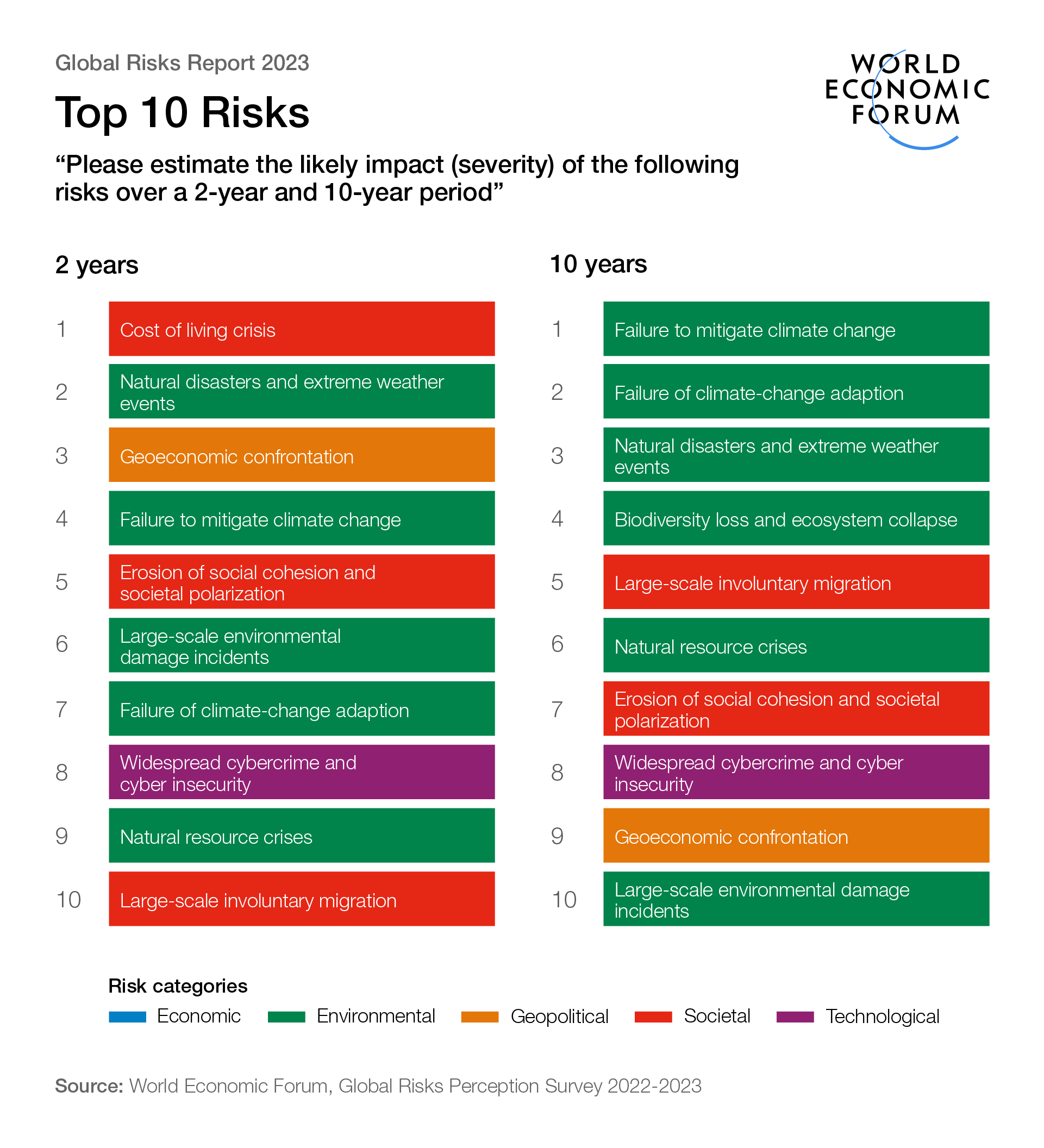

Water scarcity has profound economic implications. It affects agriculture, energy production and industrial processes, leading to increased costs and reduced productivity. Inadequate water supply can also lead to health crises, which further strains public finances. Investing in water infrastructure is not just about ensuring supply; it is about safeguarding economic stability and growth. The twin challenges of water scarcity and climate change require immediate and comprehensive responses from all sectors. For a broader overview of global risks related to the climate crisis across all sectors, see Figure 1.

By leveraging finance as a tool for sustainable development, the global water crisis can be tackled head-on while fostering economic growth and stability. Partnership between the banking sector and water management is not just about saving resources. It is about creating a future in which water security translates into economic security for all.

The need for substantial investment in water infrastructure is evident. Initiatives like the WWF’s bankable projects demonstrate that financial institutions can invest in sustainable river basin projects.3 Collaboration between banks and water agencies is essential to promote environmental stewardship and profitability.

Several regions have successfully implemented financial strategies to address water challenges. For example, the Sava River Basin Framework Agreement demonstrates that cross-border cooperation can lead to sustainable water management and conflict resolution.2 Examples such as this highlight the importance of collaborative approaches and innovative financing in addressing water issues.

Effective regulatory and policy frameworks are also essential to guide investment in the water sector. Regulators have an important role to play in ensuring that investment is directed to sustainable and effective projects.1 By setting clear guidelines and performance metrics, regulators can help attract private capital to the water sector.Adopting a sustainable approach is no longer just an ethical choice; it is increasingly influencing financial stability. Financial institutions are beginning to prioritise loans and investments that align with the Sustainable Development Goals (SDGs), ensuring that business practices do not exacerbate the water crisis.4 This shift is not only about mitigating risks but also about seizing opportunities in the growing green finance market.

In conclusion, a better understanding of water-related risks can encourage financial actors to work with companies to mitigate these risks with strategic investments, innovative financing mechanisms and sustainable banking practices. The time for action is now, and the financial sector can lead the way in addressing one of the most pressing issues of our time.

Figure.1 Top 10 Global Risks. Source: World Economic Forum Global Risks Perception Survey 2023-2024. Note: please estimate the likely impact (severity) of the above risks over 2-year and 10-year periods.

References

- Investment in the Water Industry. Retrieved from www.ofwat.gov.uk/investment-in-the-water-industry (2024).

- United Nations. UN World Water Development Report. Retrieved from un.org/sustainabledevelopment/blog/2024/03/un-world-water-development-report (2024).

- World Wildlife Fund. Water Scarcity. Retrieved from worldwildlife.org/threats/water-scarcity (2024).

- UN-Water. Water and Climate Change. Retrieved from unwater.org/water-facts/water-and-climate-change (2024).

- World Economic Forum. How Finance Can Tackle the Water Crisis. Retrieved from https://www.weforum.org/agenda/2022/07/finance-water-crisis (2022).

- World Bank. Scaling Up Finance for Water: A World Bank Strategic Framework and Roadmap for Action. Retrieved from worldbank.org/en/topic/water/publication/scaling-up-finance-for-water-a-world-bank-strategic-framework-and-roadmap-for-action (2024).

- Water UK. Water Companies Propose Largest Ever Investment. Retrieved from www.water.org.uk/news-views-publications/news/water-companies-propose-largest-ever-investment (2024).

- World Vision. Global Water Crisis: Facts. Retrieved from www.worldvision.org/clean-water-news-stories/global-water-crisis-facts (2024).