Read more

News

Executive seminar on Demography, Inequality and Inflation

Every year, the Florence School of Banking and Finance organises an executive seminar, an occasion for the members of its advisory council to gather and debate on a pressing topic in the European banking...

Our last online course of the academic year, ‘MiFIDII/MiFIR: Evolution and Revolution’ has finished last week. The course, taught by experts, practitioners and scholars, addressed the main aspects of the Directive on Markets in Financial Instruments repealing Directive 2004/39/EC and the Regulation on Markets in Financial Instruments, commonly referred to as MiFID II and MiFIR.

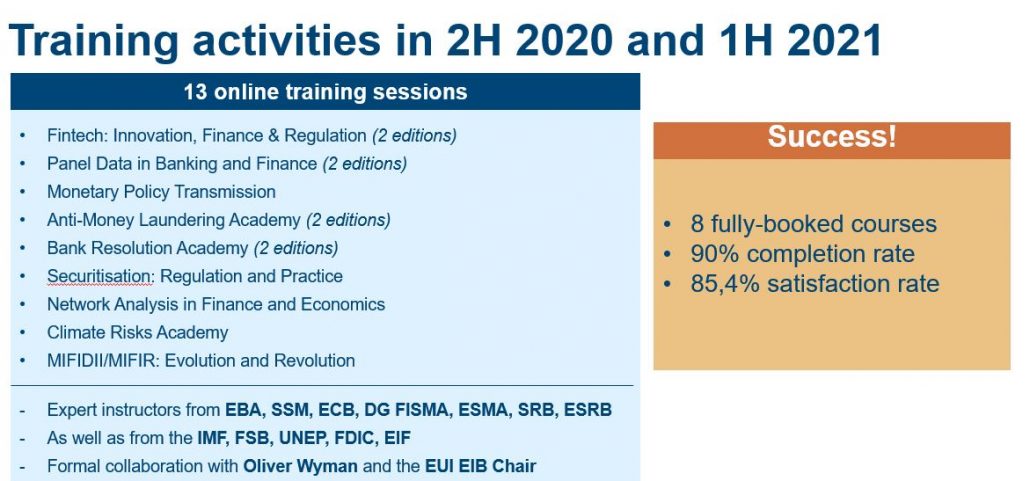

The MiFIDII/MiFIR course was the last of a series of 13 online courses which took place between the second half of 2020 and the first half of 2021. This series of courses was met with very positive results, both in terms of participation (43 participants on average per training course, 39 new organisations of origin of course participants) and feedback from course participants (with the average overall appreciation of our courses reaching 85.4%).

Furthermore, during this period, we expanded the international outreach of our courses, with 18 new countries of origin of attendees, and our network of partnerships, reflected in the variety of institutions of origin of the instructors in our courses.

But more importantly, this circle of FBF online courses has been the occasion to design and offer to online course participants a set of innovative online training formats, based on the latest trends in eLearning and on the way in which learning happens in the online format. Our courses combine academic rigor with a hands-on approach, where a particular attention is placed on personal interactions and individual exchanges.

The MiFID/MiFIR course has been an example of this format, featuring video-lectures, group exercises and practical activities.

Directed by Veerle Colaert (Chair for financial law at KU Leuven University and co-director of the KU Leuven Jan Ronse Institute for Company and Financial Law) and Matteo Gargantini (Assistant Professor of European Economic Law at the University of Utrecht, previously at Consob – the Italian Securities and Exchange Commission), the course presented to participants an in-depth overview of the MiFIDII/MiFIR rules and their interplay with recent changes in the European landscape brought by – among others – FinTech, crowdfunding, and Brexit.

Guest instructors including Eugenia Macchiavello (University of Genova), Diego Valiante (University of Bologna), Federico della Negra (European Central Bank) and interview partners from the industry helped to provide a comprehensive overview of the topics discussed, addressing them through different perspectives.

The course featured dedicated scenario analysis exercises on KYC practices and inducements, on agency problems and investor protection (working on a fictional case largely based on the Gamestop case, which arised in early 2021) and on self-placement, public and private enforcement (working on a fictional case involving structured finance products).

In addition, participants worked in small groups on a case study analysing real Europe-based crowdfunding platfroms and their activities in the light of the MiFID/MiFIR and the regulation on European crowdfunding service providers for business.