Read more

News

The FBF scientific team held a series of lectures on the EU Banking Union at UniFi

During the last weeks of March 2022, the Scientific team of the Florence School of Banking and Finance held a series of lectures on ‘the EU Financial Union’ in the framework of a collaboration...

The past weeks saw growing attention being dedicated to a set of fringe but growing financial products in the wide space of sustainable finance: ESG securitisation. One of the first dedicated workshops was hosted in London last week and gathered a significant number of investors and stakeholders.

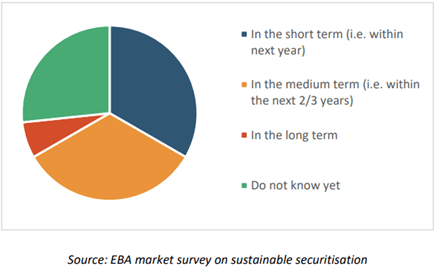

Large international law firms have been building up capacities in green structured finance over the past years. Last but not least, the European Banking Authority just published its much awaited report on sustainable securitisation which confirms an incoming market appetite among issuers as the below graph illustrates (EBA Report Developing a Framework on Sustainable Securitisation; N= 40 survey respondents).

In this context the hybrid seminar on green securitisation held by the University of Siena’s Law Department on 24 March was very timely. As outlined in a past EUI/RSC Working Paper written with Christy Petit (Petit and Schlosser, 2020) ‘green securitization can be understood as the transformation of illiquid assets (e.g. such as green loans) into liquid assets. Assets are therefore moved off-balance sheet together with their underlying credit risks ( a bank will thus have a so-called capital relief)’.

The market development of green securitisation, as our paper argues, is currently hampered by the absence of clear green standards which would however be required to limit green-washing and increase trust in this market segment given that the EU Green Bond Standard is still under negotiation and is hence not adopted yet. Yet, the EBA’s report concludes that ‘it would be premature to establish a dedicated framework for green securitisation (…). Rather, the EBA is of the view that the upcoming EU GBS regulation should also apply to securitisation, provided that some adjustments are made to the standard’.

Green securitisation will be yet again a key focal point of the now established FBF Securitisation Online Academy, to be held this June: https://fbf.eui.eu/securitisation-online-course-2022/