Sustainable Finance

Green bonds and the sustainable bond market

Home - Green bonds and the sustainable bond market

Share this course

05/09/2022 - 30/09/2022

Location

Online and in Florence

Download course programme

Level

Intermediate, Introductory

Approach

Qualitative

Delivery mode

Blended

The bond market is undergoing a deep transformation as institutional investors are increasingly attracted by a host of new financial instruments such as green bonds, sustainability-linked, social, and transition bonds. This development forms part of a broader ESG endeavour to rely on private and public sources to fund sustainable investments, to cut greenhouse gas emissions, reduce social inequalities, mitigate gender disparities and to support the economic recovery from the COVID-19 pandemic.

Portfolios of green investments, and in particular Green bond issuances are regularly, if not systematically these days, oversubscribed. The issuers of green bonds are both private and public actors, and governments play a crucial role in scaling up the sovereign issuances. Green bonds display varying design features and use of proceeds. This results in a complex and often unsettling mix of information to market participants, regulators and supervisors, and central banks. Understanding fully the role of green bonds and sustainability-linked debt instruments is now key for any market participant.

Occasionally, some green bond issuances are subject to allegations of greenwashing. These allegations -real or not- affect not only the specific bonds but risk undermining the green bond market in general. The lack of reliable information and the myriad of evaluation methodologies undermine the understanding and trust in these financial instruments. A comprehensive and consistent approach to green bonds’ analysis is needed. The voluntary EU Green Bonds Standard is an important step in this long sustainability road. Its effectiveness will be impacted by what happens to the EU Complementary Delegated Act and its inclusion of gas and nuclear energy.

Targeted at financial supervisors, risk managers and debt management officers, this course will equip participants with the fundamental analytical toolbox needed to navigate the new world of green bond finance. The course will bridge the world of practice, regulation, and supervision through the use of a series of case-studies, analysis, and practical activities.

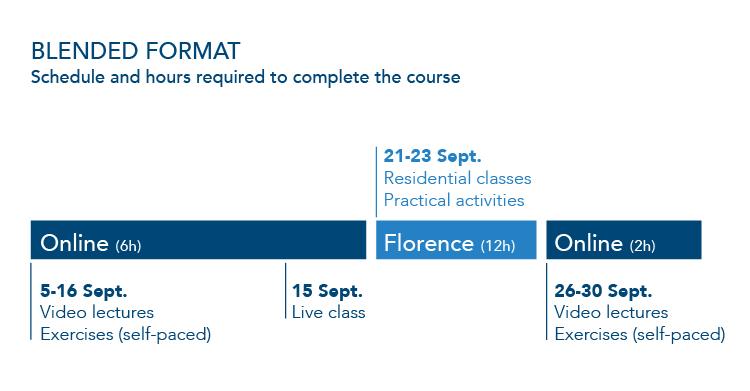

In terms of format, the course will be blended, meaning that it will be delivered both online (a few modules) and residentially in Florence.

Green and Sustainable Bonds: opportunities and challenges – Listen to the podcast with Patrizia Canziani & J.J. de Vries Robbé

15 Years After the First Green Bond by the European Investment Bank: What Next? – Listen to the podcast with Aldo Romani (EIB)

- Explore the links between ESG bonds issuance and SDG goals and encourage course attendees to reflect on the potential contribution of market participants to achieve SDG targets.

- List and compare the variety of ESG bonds available on the current international bond market

- Understand the role of the key actors involved in the issuance of green bonds

- Provide participants with an overview of the green bond market development, and a comprehensive update on standards, regulation and reporting requirements of green bonds

- Grasp the key principles and steps within the issuance of green bonds

- Critically reflect on green-washing and impact washing attempts by issuers as well as on the effectiveness of impact assessments and how the latter can be improved.

- Give participants relevant analytical tools to identify the risks and opportunities for issuers and investors within the sustainability-labelled bonds market

- Understand and assess the existent green bonds verification and supervisory frameworks

- Offer an overview of current digital and technological trends in the green bonds market

Total course length: 22 hours

The exact duration for participants depends on previous experience and time devoted to each activity, including optional.

The course will be blended, meaning that it will be delivered both online (a few modules) and residentially in Florence.

ONLINE BLOCK (5-16 september 2022):

- Module 00: Introduction to the course

- Module 0 (Optional): A refresher on bond basics

- Module 1: Sustainable finance and the bond market: an overview

- Module 2: Introduction to Green Bonds

- Module 3: Fundamentals of Green Bond Analysis: Credit Rating Analysis

RESIDENTIAL BLOCK (21-23 september 2022) :

- Module 4: Green Bonds: Legal and Regulatory framework: Standards and Principles

- Module 5: Green bonds: market development

- Module 6: Green Bonds: when the Principles meet the Market

- Module 7: The EU framework and Independent External reviews of Green Bonds

- Module 8: Green, Social, Thematic and Sustainability-linked Bonds: A practical activity

- Module 9: Roundtable discussion “Geopolitics of Debt instruments and standard setting: rise of ESG and impact measurement”

ONLINE BLOCK (26-30 september 2022):

- Module 10: Linking Fintech and Sustainability: Blockchain technology opportunities for the Green Bond Market

- Module 11 (Optional): Green Securitisation

5-16 September 2022 (Online, Mod. 0 – 3)

- Self-paced progression through video lectures and activities on the online platform, open 24/7

- Online live class: 15 September 2022, 2:00 – 3:00 PM CET

21-23 September 2022 (Residential, Mod. 4-9)

- Starting at 1:30 PM CET on Wednesday, 21st of September

- Ending with goodbye refreshers at 1:30 PM CET on Friday, 23rd of September

26-30 September 2022 (Online, Mod. 10-11)

- Self-paced progression through video lectures and activities

This course has been designed for public and private sector professionals (both at entry and mid-career levels).

Target audience:

EU officials, EBA, ESRB, SRB, National Supervisory Authorities, Supervisory and Risk management departments of Central Banks, staff members in Financial Institutions, economists in the private sector, research economists, Ph.D. and Post-doctoral researchers.

This course is open to participants from all over the world.

Degree pre-requisites

Degree in Economics, Finance, or equivalent. In alternative, participants must have relevant prior professional exposure to the course topics.

Technical pre-requisites

To join the live classes you will need to have the Zoom software installed on your computer and a webcam/microphone.

Course directors

-

Patrizia Canziani

Global Head, Capital Markets and Housing, Financial Institutions

International Finance Corporation

-

Jan Job (JJ) de Vries Robbé

Senior Counsel Legal Affairs

FMO: Dutch Entrepreneurial Development Bank

-

Pierre Schlosser

Deputy Director

Florence School of Banking and Finance

Course coordinator

-

Maria del Carmen Sandoval Velasco

Project Coordinator (CBBS)

Robert Schuman Centre for Advanced Studies

Course advisor

Guest speakers

-

Kenneth Amaeshi

Professor of Sustainable Finance and Governance

School of Transnational Governance

-

Sony Kapoor

Part-time Professor

Robert Schuman Centre, European University Institute

-

Justine Leigh-Bell

Executive Director

Anthropocene Fixed Income Institute (AFII)

-

Julien Mazzacurati

Senior Economist

European Securities and Markets Authority (ESMA)

-

Enrico Tessadro

Senior Manager

Sustainable Corporate Solutions at Sustainalytics

-

Michael Wilkins

Imperial Centre for Climate Finance and Investment

Imperial College London

-

Linda Zeilina

Part-time Professor - Florence School of Banking and Finance

International Sustainable Finance Centre

- € 2250: Private Sector

- € 1950: Public Authorities (e.g. National Competent Authorities, Central Banks) and European Institutions

- € 1150: Full-Time Professors, PhD Students, Research Associates

Please submit a certificate attesting your status of Professor, PhD Student or Research Associate to fbf@eui.eu before registering.

* Seats for academics are limited

* Limited seats per institution

Please note that the payment must be settled before the start of the course.

The fee includes tuition, access to all course materials and pedagogic activities, coffee and lunch breaks and social activities. It does not include travel and accommodation expenses or other local transportation costs (taxis, private cars).

A certificate of attendance will be provided to all participants after the course.

FEE WAIVERS:

A few fee waivers are available to outstanding candidates applying from, and resident in, low-income and lower-middle-income economies (as set by the World Bank) in the Americas, Africa and Asia.

The deadline for applying for a fee waiver is Monday 22 August 2022.

To apply for a scholarship, send your CV and a cover letter to the course secretariat at fbf@eui.eu.

CANCELLATION POLICY:

- In case you can no longer attend the course, you are required to inform the organisers by sending an email to fbf@eui.eu in order to free a seat for participants in the waiting list.

- In case of frequent cancellations, FBF reserves the right not to accept further registrations from the same person.

Accommodation

Please notice that the course dinner, and most of the social activities, will take place downtown.

Recommended hotels nearby the EUI:

Recommended hotels in downtown Florence:

Suggested restaurants in Florence city centre

- Restaurant Accademia – Ph. +39 055 217343

- Restaurant Cucina Torcicoda – Ph. +39 055 265 4329

- Finisterrae – Ph. +39 0552638675

- Il Vezzo – Ph. +39 055 281096

- Osteria di Giovanni – Ph. + 39 055 284897

Wi-Fi

On arrival, participants will be provided with temporary wi-fi access for the whole duration of the course.

For general queries: fbf@eui.eu

GENERAL INFORMATION ON LOCAL TRANSPORT

From Florence airport:

Florence airport is located 8 km from the city centre, approximately 30 minutes by taxi or bus. Taxis can be found outside the arrivals terminal; no reservation is needed. A taxi ride from the airport costs about €20 and takes approximately 25/30 minutes.

A tramway (line T2) connects the airport to the city centre. Trains leave from the airport terminal and take 20 minutes to the main railway station. One-way tickets can be bought from vending machines for €1.50.

From the central railway station:

Take bus n. 7 at the bus stop Stazione Nazionale in the direction “Fiesole Piazza Mino”, get off at the stop ‘San Domenico 01’. For bus routes and timetables consult the official timetable.

Bus tickets are sold outside the railway station, at Autolinee Toscane ticket kiosks and vending machines, tobacconists (tabacchi), newspaper kiosks (edicole), and most cafes (bar). They must be bought before boarding and stamped using the machine on the bus. A ticket costs €1.50 and it is valid for 90 minutes. Bus tickets can be purchased also on board (€ 2.50), but the driver is not obliged to give change.

Private car

From the A1 Milano-Napoli (Autostrada del Sole), take the Firenze Sud exit and follow directions to the city centre/Stadio. Follow the directions to the stadium (Stadio), then for Fiesole. San Domenico is on the main road to Fiesole.

The EUI has several free parking areas available all over the Campus, that can be used during the days of the event (not for the night/s).