Read more

News

Digital Currencies Academy closed on 10th May

On the days from 26th to 28th April, we welcomed the participants of the ‘Digital Currencies Academy’ at our premises in Florence, Italy. The Academy was the first blended course offered by our School....

Remittances from family members in other parts of the same country or abroad have been a key income source for many vulnerable households in developing countries, enabling them to meet vital expenses such as foods, healthcare, and education, and substituting for lacking public social safety nets. For example, in 2019, right before the pandemic, remittances to low- and middle-income countries amounted to $540 billion. At the same time, the costs of sending international remittances are still very high, even though they have come down over the last decade.

Using data across 365 corridors over the period 2011-2020 from the World Banks’ database on Remittance Prices Worldwide, R. Kangni Kpodar, Mathilde Janfis and I document variation in remittance costs across corridors, over time and across providers, and analyse the factors this variation driving, in a recent IMF Working Paper.

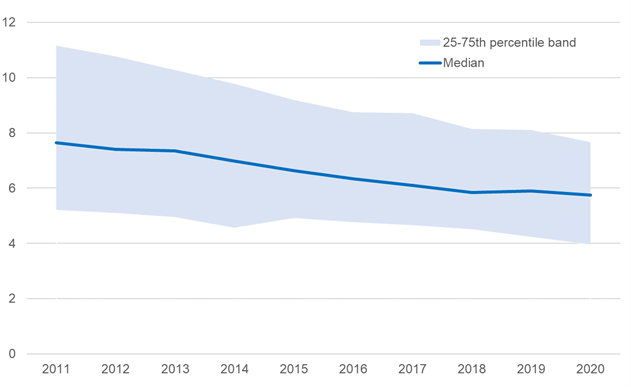

Figure 1 shows that the fees for a $200 remittance have come down significantly over time, although they seemed to have stagnated in the last 3 years. The median remittance fee has decreased from 7.7 percent in 2011 to 5.7 percent in 2020. The reduction was also broad across the distribution of remittance fees, with the 75th percentile decreasing from 11.1 percent to 7.7 percent, and the 25th percentile falling from 5.2 percent to 4 percent. Nevertheless, most of the corridors still have median remittance cost above 5 percent in 2020, far from the 2030 Sustainable Development Goal target of average fees of less than 3 per cent and no remittance corridors with costs higher than 5 per cent.

… reflecting cost- and risk-based constraints and market structure

When exploring the factors behind the variation, five results stand out:

- Higher GDP per capita in the sending country and easier geographic access to financial institutions is associated with lower fees, especially for banks.

- Scale economies matter: a larger market for remittances (as proxied by closer economic ties and a larger migrant population from the receiving in the sending country) is associated with lower costs as is a shorter distance between sending and receiving countries.

- The market structure is important: banks charge higher fees than money transfer operators (MTOs), but a larger share of banks among remittance service providers is also associated with higher fees charged by MTOs. Unlike banks, MTOs’ fees react to competitive pressures, with more market players being associated with lower MTO but not bank remittance fees.

- In corridors where the sending country has a pegged exchange rate, both banks and MTOs charge lower fees.

- There is some evidence that cash payments attract higher fees, while payments over the Internet are charged lower fees.

Overall, these findings point to both cost- and risk-based constraints and market structure as barriers to lower remittance fees. Higher transaction costs as result of a more rural population in the sending country and lower scale can explain high remittance fees in some corridors. These factors are largely structural, implying a limit to the extent to which remittance fees can be lower with policy actions.

However, decisive policy actions are needed in areas that are directly under the control of policy makers and where the yield from reforms can quickly materialize. For instance, stronger competition through easing entry to the remittance market, especially for non-bank providers, and digitalization might help reduce remittance costs. Similarly, exchange rate stability (or better hedging possibilities) might contain remittance costs, more so because exchange rate margins (often not fully disclosed by remittance service providers) can make up a significant portion of the remittance fees in corridors where exchange risks are the highest. The one area where our analysis cannot really make any clear inferences (due to endogeneity concerns) is on the role of the regulatory framework in its direct effect on remittance costs.

A longer version of this blog entry has been published on VoxEU on 18 April 2022.