-

Nico Lauridsen

Research Associate

Robert Schuman Centre for Advanced Studies

Read more

Blog

The missing component of monetary policy and inequalities

Monetary Policy and inequalities In my last blogpost, I conducted a brief literature review which concluded that monetary policy is deemed to have negligible distributional outcomes in the long run provided that central banks...

Covid-19 disrupted how we access and use financial services, marking a pivotal shift in the fintech industry. The Global Covid-19 Fintech Market Impact and Industry Resilience Study was jointly developed by the Cambridge Centre for Alternative Finance (CCAF) at the University of Cambridge Judge Business School, the World Economic Forum and the World Bank Group to investigate the medium-to-longer-term impact of the pandemic on the global fintech industry and review the findings from three years ago reported in the first edition of this study (The Global Covid-19 FinTech Market Rapid Assessment Study).

Globally, fintech platforms reported an increase of 47% in gross values transacted from in 2019 to in 2020. The study revealed that this growth was influenced by the following main factors:

- Fintechs operating in advanced economies (AEs) reported higher increases in transaction values than those in emerging markets and developing economies (EMDEs).The transaction value of digital payment fintechs accounted for 63% of all retail-facing fintechs. Although firms in AEs contributed to most of the total value of annual payment transactions, firms in EMDEs grew at a faster pace.

- Firms in jurisdictions with more stringent lockdown measures reported faster growth.

- Where governments used fintech platforms as distribution channels for Covid-19 relief packages, this contributed to overall fintech market growth.

- Customer base fintech platforms contributed to supporting financial inclusion during the pandemic. A large proportion of fintech clients were new customers, and customers from groups that in many countries have been underserved by traditional financial institutions, such as small and medium enterprises, low-income households and women.

The report highlights that the accelerated pace of fintech development requires regulatory support more than ever to ensure the benefits of growth are widely shared, risk is managed and overall industry growth is supported.

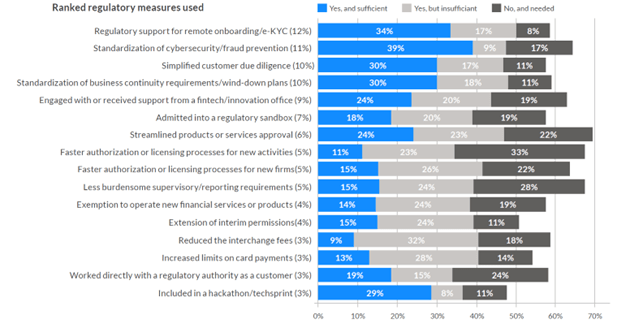

The figure below, from the CCAF’s Rapid Assessment Study, shows fintechs’ use of regulatory support initiatives in 2020. The most used initiatives related to supporting customer acquisition and management, such as remote onboarding, simplified customer due diligence and cybersecurity standardisation measures. The focus on enhanced cybersecurity measures suggests that digital infrastructure and connectivity have been put under pressure during the pandemic, and highlights the need for regulators to create strong and comprehensive frameworks that inspire confidence (BIS, 2021). Indeed, fintech firms identified faster authorisation or licensing processes for new activities and less burdensome supervisory requirements as the two areas that most needed support. Regulatory and digital sandboxes appear to be the most desired elements in reducing barriers to market entry and controlling the risks arising from applying emerging technologies to new business models (BIS, 2021).

Regulatory support initiatives: all fintech verticals

As the market continues to develop, regulators and supervisors should rethink their role under an innovation agency perspective that facilitates technological development, foster competition and maintains financial stability (World Bank, 2022; FSB, 2022).

You can find the full report here.

*Nico Lauridsen has recently joined the Florence School of Banking and Finance as a Research Associate. He has been previously working with the Cambridge Centre for Alternative Finance (CCAF) at the University of Cambridge Judge Business School.