Read more

News

Annual Conference and Women in Finance - FBF hosted two intense days of Policy dialogue

On 14th and 15th of June, the Florence School of Banking and Finance hosted two insightful days of policy dialogue that reunited in Florence high-level speakers from the European institutions, private sector and Academia....

The SARS-CoV-2 pandemic, an exogenous, sudden, and symmetric shock, has provoked unprecedented challenges in most of the world by halting the real economy. The combination of global chain disruptions affecting the supply, and containment measures shifting the demand, collapsed global economic activity in a way not experienced in more than a century.

Governments around the globe have implemented several types of policies aiming to contain the spread of the virus, leveraging on lockdowns measures that restricted mobility and affected specific economic sectors. These policies affected mainly low-income workers with less education, minorities, immigrants, and women.

Simultaneously, lockdowns forced significant changes in spending patterns. Trying to reduce exposure to the virus, individuals modified behaviours and detrimentally decreased mobility in contact-intensive sectors such as retail, tourism, and hospitality, triggering e-commerce and accelerated digital transformation.

Financial services were one of the industries benefiting the most from these behaviour changes. In response to rising infections, voluntary social distancing pushed users to demand more digital services and forced a transformation in many institutions with legacy information-technology operating systems. In this context, financial-technology firms (Fintech) offering cutting-edge solutions had a comparative advantage by providing digital financial services with higher efficiency and lower costs.

Leveraging on these advantages, governments worldwide relied on Fintechs and banks with robust digital platforms to deploy economic relief programmes in populations with significant welfare deterioration due to the pandemic. These programmes aimed to reduce the effects of the pandemic on households with non-contributory cash transfers to support consumption for the most vulnerable population.

According to the Center for Financial Inclusion (2022), the number of government assistance programmes went from 103 in March 2020 to 1,841 in May 2021, reaching more than 1.5 billion people. Many of these programmes used digital infrastructures to deliver funds quickly without physical contact, implying a significant growth in the number of digital savings accounts and wallets.

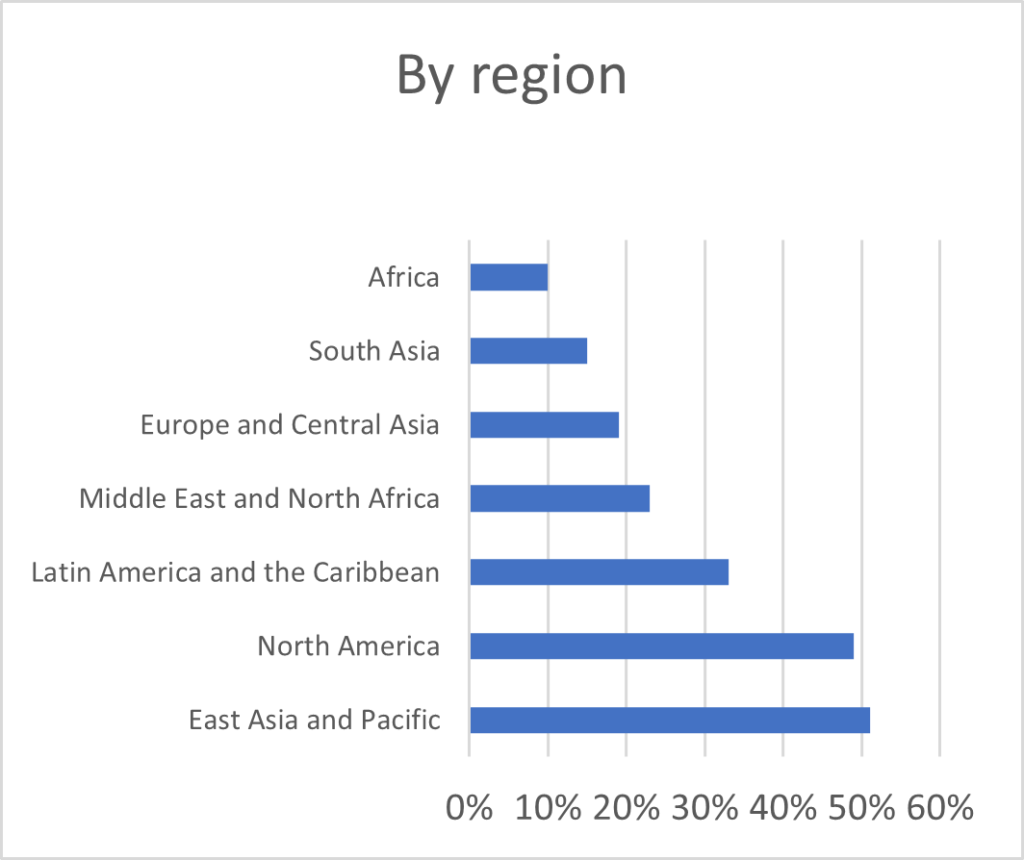

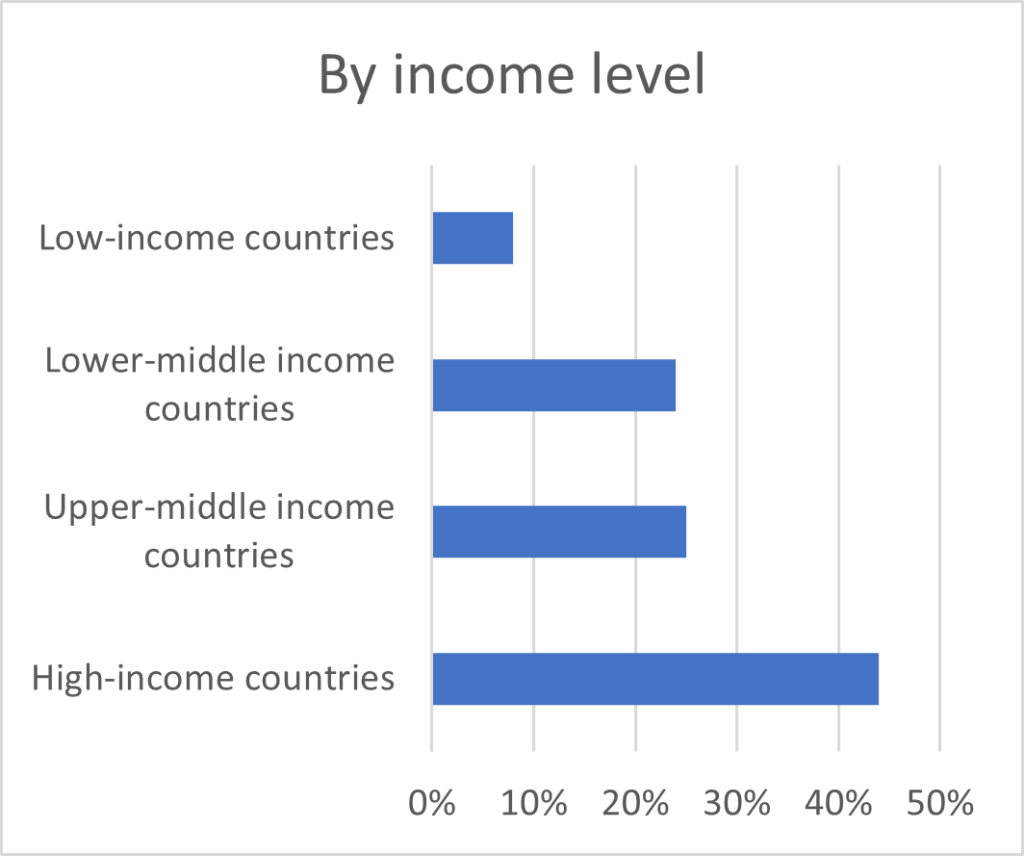

Calculations by Gentilini et al., (2022) at the World Bank show that approximately 50% of the population in North America and East Asia, and the Pacific received at least one unconditional transfer, while this figure drops to 19% in Eastern Europe and Central Asia and 10% in Africa. Of the 202 cash transfer programmes studied, 58% were disbursed through digital payments and 22% through manual and digital payments. Interestingly, low-income countries display the highest share of digital payment deployment with 63%. In many countries, government support was vital to stabilising consumption after the shock: The size of cash transfer programs represents, on average, 30% of monthly GDP per capita for all regions and 25% for Europe and Central Asia. In monetary value, monthly transfers averaged USD 256, ranging from USD 525 in high-income countries to USD 42 in low-income countries.

Cash transfer coverage by income level and by region

Source: Gentilini et al., (2022)

The rapid global deployment of Government-to-person (G2P) payments, designed to mitigate the economic effects of COVID-19, implied a significant improvement in access to financial services, mainly digital accounts. However, there is still room for improvement as many implementation problems arose in many jurisdictions highlighting the need to enhance digital ecosystems. In particular, to develop interoperable payment infrastructures, design better digital identity frameworks, focus on usage, and strengthen joint ventures between merchants, financial service providers, and mobile network operators.

We must shift from the access paradigm of financial inclusion toward one of financial health, where economic empowerment is the center of public policies. Welfare does not derive directly from the ownership of accounts but from their appropriate and consistent use that satisfies the various needs of the users. Setting up a better financial architecture will help us be more resilient to future crises and make the financial services more inclusive and sustainable.

References

Davidovic, S. et al. 2020. “Beyond the COVID-19 Crisis: A Framework for Sustainable Government-To-Person Mobile Money Transfers,” IMF Working Papers, 2020(198). Link.

EY. 2021. “How technology is driving competitive advantage in financial services”. Link

Gentilini, U. et al., 2022. “Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures.” World Bank. Link

Kiuhan, S. 2022. “Show me the money: Household Finances and G2P payments in times of COVID-19”. Unpublished Working paper.

Rizzi, A. 2022. Responsible Social Protection: Lessons From COVID-19 Digital Cash Transfers. Center for Financial Inclusion – ACCION. Link

UNCTAD. 2021. COVID-19 and e-commerce: a global review. Link