-

Lorenzo Moretti

Research Fellow

Robert Schuman Centre for Advanced Studies

-

Nikolas Passos

Research Associate

Robert Schuman Centre for Advanced Studies

Read more

News

Financing growth and innovation in Europe: economic and policy challenges

The Florence School of Banking and Finance (FBF), in collaboration with the Bank of Italy, successfully hosted its Annual Conference on 10-11 March 2025 at the European University Institute in Florence, focusing on the...

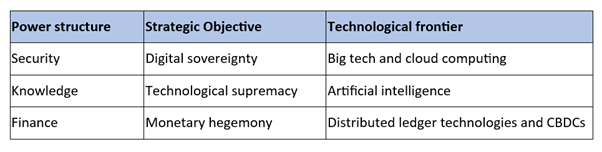

Financial innovation is increasingly becoming a critical tool in the geopolitical arsenal (Lauridsen & Passos, 2024). As digital finance continues to evolve, its trajectory is now intertwined with a complex multipolar world marked by a growing nationalistic focus and international instability (Szczepanski, 2024; Torkington, 2024). In addition, new national strategic objectives, such as digital sovereignty, technological supremacy and monetary hegemony, are shaping the speed and direction of financial innovation (See Table 1). More broadly, as the first moves by the new U.S. administration show, technological ambitions are becoming fundamental drivers of geopolitical positioning.

Table 1: Strategic Objectives and Technological Frontiers in Digital Finance Geopolitics

The interactions among these elements will play a crucial role in determining the future landscape of digital finance. Uncoordinated pursuit of these strategies will lead to fragmentation of the global financial system.

Digital sovereignty and big tech concentration

National security consists in the safety of a country’s people and assets. As money – together with personal and other data – moves to digital formats, digital sovereignty becomes a key contributor to this (in)security. As major big tech companies, mostly American and Chinese, play an increasingly pivotal role in technological advances in digital finance, this market concentration poses an ever-clearer risk. These companies provide critical digital infrastructure, including cloud services, cybersecurity software and AI applications, which impact operational resilience and cybersecurity (JC ESAs, 2024, p.12). The concentration in processing and storage is vast: three American companies (AWS, Microsoft and Google) and two Chinese ones (Alibaba and Tencent) together have more than two-thirds of the cloud storage market share (Richter, 2024). These technologies and services are no longer merely products but critical infrastructure in the global financial system.

Technological supremacy and artificial intelligence

The development of AI technologies has introduced a new dimension in the geopolitical landscape of digital finance. “Notable machine learning models” are heavily concentrated in a few countries. The United States leads the field (Maslej et al., 2024), but China has been showing increased prominence recently. In 2023 U.S.-based institutions developed 61 notable models, compared to 21 in the European Union and 15 in China (Maslej et al., 2024). This concentrated AI ecosystem can embed correlated biases, potentially resulting in inadequate risk assessment and financial instability (Aldasoro et al., 2024). More broadly, as AI becomes ubiquitous, technological leadership in this field increasingly becomes a strategic priority for nations.

The monetary hierarchy and decentralisation of money

The digitalisation of finance also challenges the main structures in the international monetary system. In recent decades, the dominance of the US dollar has been pervasive, with consequences for trade and finance (Gopinath et al., 2020). However, new monetary alternatives may arise if companies and governments increase their use of distributed ledger technologies. On the private front, crypto assets, especially stablecoins, present challenges to banks and payment institutions and can lead to restructuring the financial system (Catalini and Wu, 2024). In response, 134 countries representing 98% of global GDP are also exploring the implementation of central bank digital currencies (CBDCs), thus aiming to preserve the monetary role of the central bank (Atlantic Council, 2024). Beyond national CBDC projects, initiatives like the BRICS-Bridge propose a cross-border payment system designed to bypass the U.S. dollar-based system (The Economist, 2024). This represents the best example of how this technology can subvert the existing order.

Suggestion:

If you are interested in exploring more details, see https://cadmus.eui.eu/handle/1814/77926

References:

Aaronson, S. A. (2024). The Age of AI Nationalism and Its Effects. Center for International Governance Innovation Papers No. 306. Available at https://www.cigionline.org/publications/the-age-of-ai-nationalism-and-its-effects/ (last accessed 22/10/2024).

Aldasoro, I., Gambacorta, L., Korinek, A., Shreeti, V. & Stein, M. (2024). Intelligent financial system: how AI is transforming finance. BIS Working Papers No 1194. Monetary and Economic Department, June 2024.

Atlantic Council. (2024). Central Bank Digital Currencies Tracker. Available at https://www.atlanticcouncil.org/cbdctracker/ (last accessed 22/10/2024).

Catalini, C. & Wu, J. (2024). The Race to Dominate Stablecoins. Harvard Business Review. Available at https://hbr.org/2024/08/the-race-to-dominate-stablecoins (last accessed 22/10/2024).

JC ESAs. (2024). Report on 2023 stocktaking of BigTech direct financial services provision in the EU. Joint Committee of the European Supervisory Authorities.

Lauridsen, N & Passos, N. (2024) Market developments based on digital technologies. In Moretti et al. (eds), Digital finance in the EU: navigating new technological trends and the AI revolution, Florence: EUI, 2024, pp. 12-34.

Maslej, N., Fattorini, L., Perrault, R., Parli, V., Reuel, A., Brynjolfsson, E., Etchemendy, J., Ligett, K., Lyons, T., Manyika, J., Niebles, J. C., Shoham, Y., Wald, R. & Clark, J. (2024). The AI Index 2024 Annual Report. AI Index Steering Committee, Institute for Human-Centered AI, Stanford University. Available at https://aiindex.stanford.edu/report/ (last accessed 22/10/2024).

Richter, F. (2024). Amazon Maintains Cloud Lead as Microsoft Edges Closer. Statista. Available at https://www.statista.com/chart/18819/worldwide-market-share-of-leading-cloud-infrastructure-service-providers/ (last accessed 22/10/2024).

Szczepanski, M. (2024). The geopolitics of technology: Charting the EU’s path in a competitive world. European Parliamentary Research Service. Available at https://www.europarl.europa.eu/RegData/etudes/BRIE/2024/762384/EPRS_BRI(2024)762384_EN.pdf (last accessed 22/10/2024).

The Economist. (2024, October 20). Putin’s plan to defeat the dollar. The Economist. Available at https://www.economist.com/international/2024/10/20/putins-plan-to-defeat-the-dollar (last accessed 22/10/2024).

Torkington, S. (2024, September 10). Geopolitics replaces inflation as the top worry for central banks and sovereign wealth funds. World Economic Forum. Available at https://www.weforum.org/agenda/2024/08/geopolitics-inflation-central-banks/ (last accessed 22/10/2024).