-

Nico Lauridsen

Research Associate

Robert Schuman Centre for Advanced Studies

Read more

Blog

Is this time different? Lessons from recent crypto turmoil

Past May, the third largest so-called stablecoin TerraUSD and its sister token Luna imploded, obliterating a combined market value once estimated at USD 60 billion. The crash of this algorithmic stablecoin -not backed by...

The fintech market has radically changed the financial landscape, redesigning financial intermediation’s business models leveraging emerging technologies’ potentiality in generating economy of scale, scope, and network effect. While fintech companies have increased competition in the market, giving access to specific financial services through new digital channels this endogenous force of innovation comes from the combinations of business models and technologies operating in blind spots that are not covered by the current regulatory framework. Non-regulated entities are challenging regulators and supervisors with potential regulatory arbitrage that could threaten at once financial stability, consumer and investor protection, market efficiency and integrity. This has led to a fundamental discussion among regulators on finding the right balance in policy trade-offs on financial innovation.

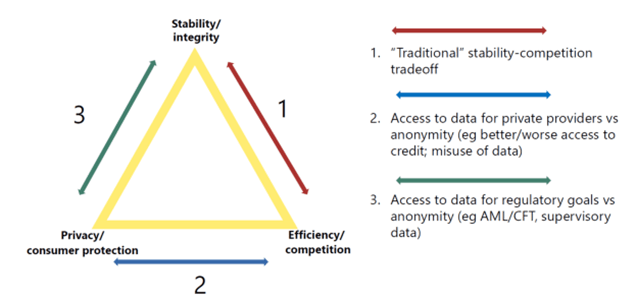

Figure 1 presents how the traditional trade-off between market competition and financial stability and integrity has become three-dimensional, including the data dimension: in such context, an appropriate regulation should be designed to enable financial innovation and to establish trust in accessing and using data; on the one hand, for supporting innovation and competition in the financial intermediation market; on the other, to ensure the availability of the supervision tools required to maintain financial stability and customer protection.

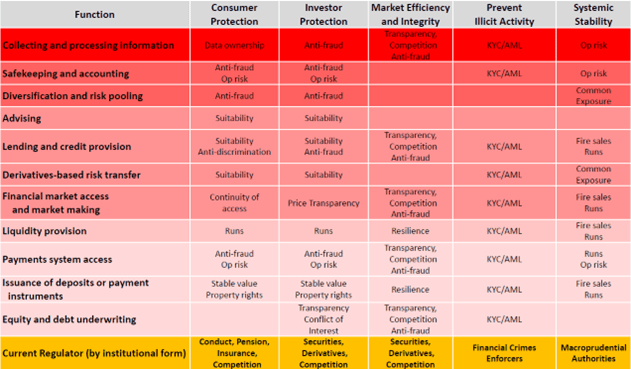

To tackle the challenges that fintech firms impose, regulators should reverse their perspective on entity-based regulation, trying to have more flexible and adaptable frameworks, as much as the technologies and business models are. Indeed, the risks are still the same as traditional financial intermediaries, but with more specialized entities that focus on a specific product. The approach that could be applied is “same risk for the same rule” to have more horizontal regulations capturing the heterogeneity in the market.

Figure 2 shows regulatory objectives by function identified and, at the bottom, what is covered by the current regulatory framework from an entity-based approach. However, the debate about how new entrants in the financial intermediation market should be regulated and supervised is still open.

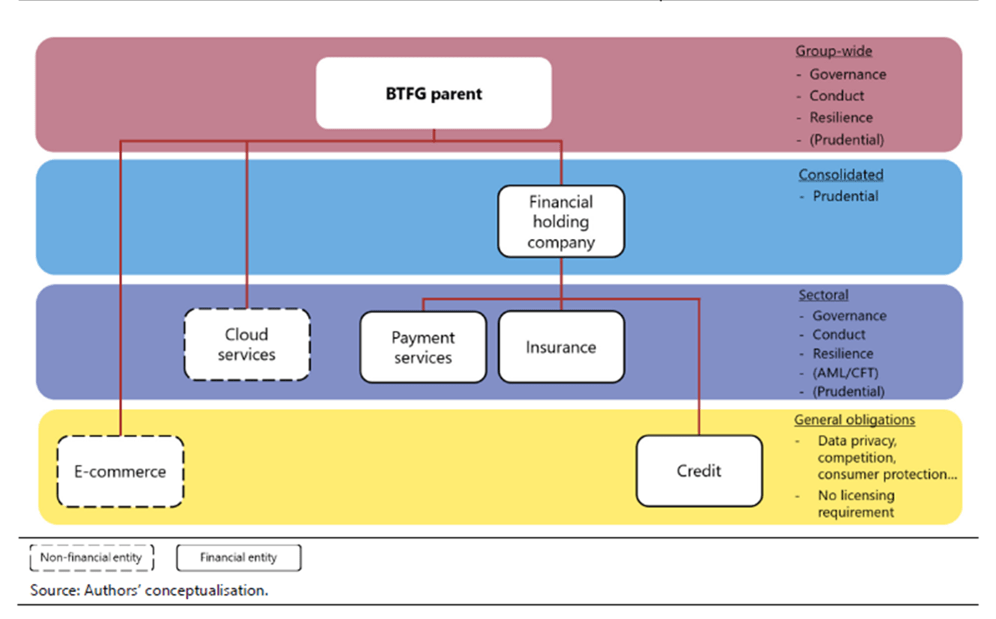

The real force of disruption and threat to financial stability comes from big tech financial groups (BTFG) entering the financial intermediation market as native non-regulated platforms. BTFG provide technology solutions to incumbents and compete in the market, offering standard financial products at a global level. Inevitably, this represents an additional complexity for regulators in an identified framework that considers systemic relevance, cross-intragroup interdependence, and network externality that derives from financial and non-financial products. Figure 3 looks at a possible framework to approach BTFGs business models, combining activity-based and entity-based regulations where the source of risks is matched with the levels of corporate entity structure. In the end, the risk of regulatory capture by the speed of innovation is still high under different approaches, is evidence of how regulatory and supervision collaboration is needed to develop future frameworks that are more modular and adaptable to different technologies.

References

- Borio, C., Claessens S., and Tarashev N. (2022). Entity-based vs activity-based regulation: a framework and applications to traditional financial firms and big techs. BIS Occasional Paper No 19.

- Ehrentraud, J., Lloyd Evans, J., Monteil A., and Restoy F. (2022). Big tech regulation: in search of a new framework. BIS Occasional Paper No 20.

- Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., and Saal S. (2021). Fintech and the digital transformation of financial services: implications for market structure and public policy. BIS Papers No 117.

- Stephen G. Cecchetti. (2022). Same Function, Same Risks, Same Regulation. Money, Banking, and Financial Markets.

This blog post has been produced in the framework of the EU Supervisory Digital Finance Academy (EU-SDFA).

This blog post has been produced in the framework of the EU Supervisory Digital Finance Academy (EU-SDFA).

The EU Supervisory Digital Finance Academy (EU-SDFA) is a TSI flagship initiative aimed at supporting financial supervisory authorities in coping with the risks and opportunities associated to the use of advanced technologies in the financial sector. The European Commission – DG Reform has established the Academy in cooperation with the three European Supervisory Authorities (EBA – ESMA – EIOPA) and the Florence School of Banking and Finance part of the Robert Schuman Centre of the European University Institute (FBF-EUI).