Read more

Blog

The next SupTech generation: a time for collaboration, a hub and spoke approach

Emerging financial supervision (SupTech) technology applications have been increasing since the impact of the pandemic. During the COVID-19 outbreak, national competent authorities (NCAs) followed the same market trends that encouraged the adoption of new...

An extensive literature documents that economic growth is associated with financial deepening, e.g. as is reflected by an increase in private credit. Elevated levels of private leverage, however, raise concerns about financial stability as households and firms may be less resilient to shocks and experience greater increases in default rates and stronger deleverage spirals if they are confronted with adverse circumstances. Gauging developments in private leverage is therefore critical for macro-financial stability.

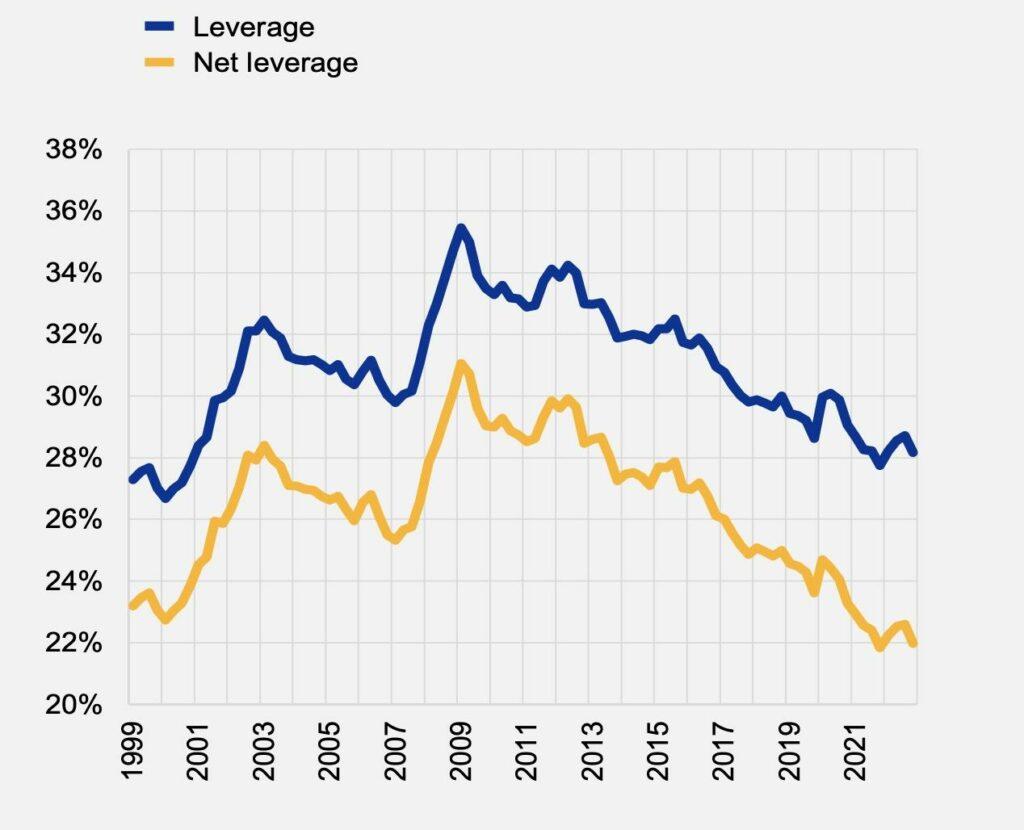

In a recent Advisory Scientific Committee (ASC) of the European Systemic Risk Board (ESRB) report, we offer a long-term view of the evolution of corporate leverage in the EU since the introduction of the euro and compare it with contemporary trends in other advanced economies. Rather than using the standard indicator of credit to (sectoral) GDP, we choose to focus on corporate leverage, the traditional object of attention in the literature on the capital structure of firms. We find an unprecedented steady decline in corporate leverage, a trend that is confirmed for most EU countries and non-financial corporations in different industries of different sizes since 2008 (Fig. 1).

Clearly, a general decline in corporate leverage does not necessarily imply fewer concerns about financial stability. First, if firms reduce their leverage in response to worse prospects or higher uncertainty, they may not become less vulnerable. Second, falling average aggregate leverage may conceal important subsets of firms exposed to debt overhang problems and at high risk of financial distress (usually called ‘zombies’). Only studying more granular data can address these issues.

The report discusses various factors that might explain this drop in leverage, driven by both supply- and demand-side factors, without offering a conclusive verdict. A reduced credit supply may be due to recent crises that have induced bank regulatory reforms, while demand-side factors include lower tax shields, a decline in investment opportunities and a change in corporate asset composition that alters firms’ preferred sources of funding.

The decline in corporate leverage has gone hand in hand with a major reallocation of credit to governments and to a lesser extent to household mortgages in this period. This ongoing process of credit reallocation away from corporate to household credit requires macroprudential authorities to focus more on the mortgage lending sector.

Beck, T., Peltonen, T., Perotti, E., Sánchez Serrano, A. and Suarez, J. (2023), “Corporate credit and leverage in the EU: recent evolution, main drivers and financial stability implications,” European Systemic Risk Board, Reports of the Advisory Scientific Committee, No 14.

Figure 1: Aggregate Leverage in the euro area, 1990 to 2021

Source: Beck et al. (2023). Gross leverage is the ratio of total (bank, trade and market) debt to total assets. Net leverage subtracts cash holdings from both gross debt and gross assets.

This blog entry is a shortened version of the following VoxEU column.